All Categories

Featured

Table of Contents

You might be asked to make additional premium settlements where coverage could terminate since the passion price went down. The assured rate given for in the plan is a lot reduced (e.g., 4%).

You have to get a certificate of insurance explaining the arrangements of the team policy and any kind of insurance policy fee. Usually the maximum amount of coverage is $220,000 for a home loan and $55,000 for all other financial obligations. Credit history life insurance coverage need not be bought from the organization giving the funding

Term Life Insurance With Critical Illness Rider

If life insurance policy is required by a lender as a condition for making a car loan, you may be able to appoint an existing life insurance coverage policy, if you have one. You may desire to acquire team credit scores life insurance in spite of its greater price because of its convenience and its availability, usually without detailed evidence of insurability - after the extended term life nonforfeiture option is chosen, the available insurance will be.

However, home collections are not made and costs are mailed by you to the agent or to the company. term life insurance vs ad&d. There are particular variables that have a tendency to raise the costs of debit insurance coverage more than normal life insurance strategies: Particular expenses are the very same regardless of what the dimension of the policy, to make sure that smaller sized policies released as debit insurance will certainly have greater premiums per $1,000 of insurance than larger size regular insurance coverage

Extended Term Option Life Insurance

Because very early lapses are pricey to a business, the costs should be passed on to all debit policyholders. Given that debit insurance coverage is designed to include home collections, greater compensations and costs are paid on debit insurance policy than on regular insurance policy. In most cases these greater costs are handed down to the insurance policy holder.

Where a company has different costs for debit and regular insurance coverage it may be possible for you to acquire a larger quantity of regular insurance than debit at no extra expense. As a result, if you are thinking of debit insurance policy, you must absolutely check out routine life insurance coverage as a cost-saving alternative.

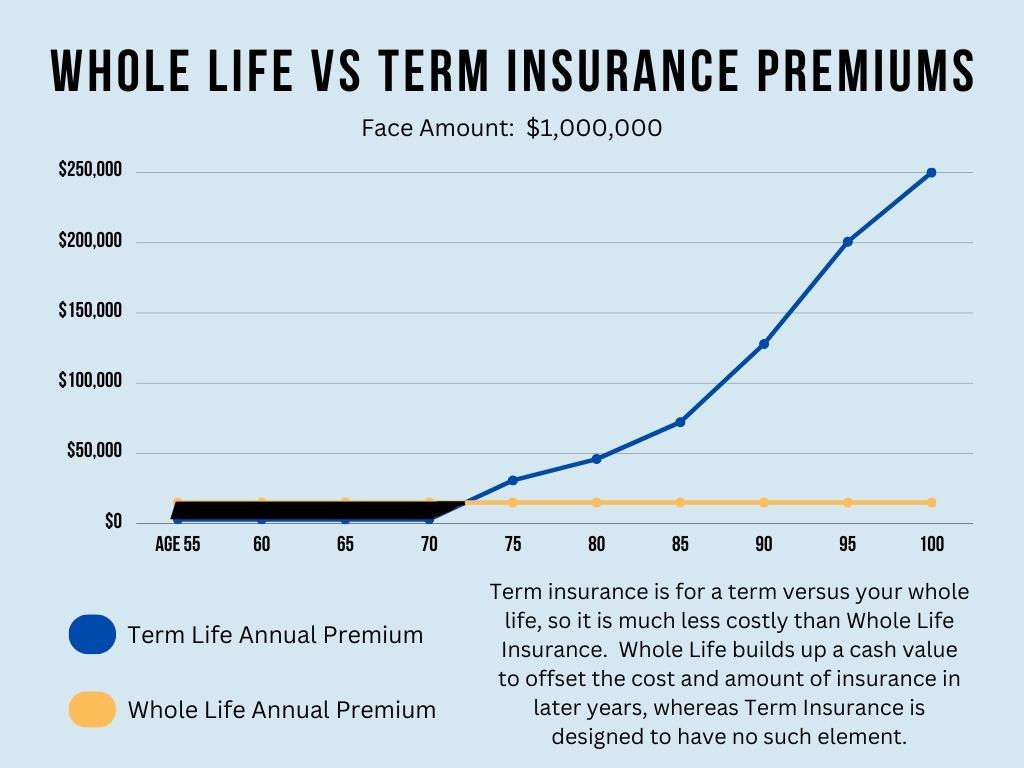

This plan is made for those that can not originally afford the normal entire life costs however that want the higher costs insurance coverage and feel they will become able to pay the greater premium - credit life insurance is generally blank______ expensive compared to equivalent term life insurance.. The family policy is a combination plan that supplies insurance policy security under one contract to all members of your prompt household husband, spouse and children

Joint Life and Survivor Insurance policy gives coverage for 2 or even more persons with the death benefit payable at the fatality of the last of the insureds. Premiums are dramatically lower under joint life and survivor insurance coverage than for plans that insure only one individual, considering that the chance of having to pay a fatality case is lower.

Premiums are dramatically greater than for policies that insure a single person, since the possibility of needing to pay a death case is greater - ladderlife cost for term life insurance. Endowment insurance supplies for the payment of the face quantity to your recipient if death takes place within a specific time period such as twenty years, or, if at the end of the details duration you are still to life, for the settlement of the face quantity to you

Latest Posts

How Many Years Of Term Life Insurance Do I Need

Voluntary Term Life Insurance Meaning

Final Expense Protection